Making financing tools and solutions more inclusive can provide women farmers with equitable opportunities for accessing irrigation equipment and succeeding in agripreneurship.

At Cultivating Equality: Advancing Gender Research in Agriculture and Food Systems, a virtual conference that focused on the role gender research can play to overcome marginalization and social exclusion, Feed the Future Innovation Lab for Small Scale Irrigation (ILSSI) Director Nicole Lefore presented recent research on gender biases in asset-based financing tools used in the small scale irrigation sector.

It is well established that women farmers face higher socio-cultural barriers and credit constraints than men, preventing them from investing in productive irrigation assets and realizing their entrepreneurial aspirations. ILSSI is supporting efforts to overcome such barriers by co-developing new, gender-responsive financing tools with private sector solar irrigation companies.

In general, solar irrigation pump companies in sub-Saharan Africa are attempting to fill a credit gap through asset-based financing, which can enable people ‘at the bottom of the pyramid’, including women farmers, to overcome credit barriers. However, companies’ credit risk assessment tools are not designed to be gender sensitive, and companies do not even target women farmers as potential clients.

How to reach women farmers

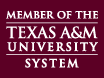

In recent research, combining a literature review, tool analysis and action research, Lefore and colleagues investigated whether asset-based financing tools and solutions can be made more inclusive and thereby increase women’s access to productive assets. Interim findings have revealed that even non-asset-based financing products do not necessarily overcome the main constraints limiting women’s access to credit for assets, and financial instruments using new approaches may still be unresponsive to women farmers and value chain actors.

Instead, the preliminary findings indicate that knowledge sharing through multi-stakeholder dialogues can raise awareness about women farmers as a market segment and that reaching women farmer clients requires a targeted marketing and finance approach. The research also revealed that some innovative companies are adapting their marketing and financial tools to expand their client base to include women farmers.

A pathway toward women’s empowerment

This could be good news for women farmers in that other research presented at Cultivating Equality contributed to establishing a link between small scale irrigation and women’s empowerment.

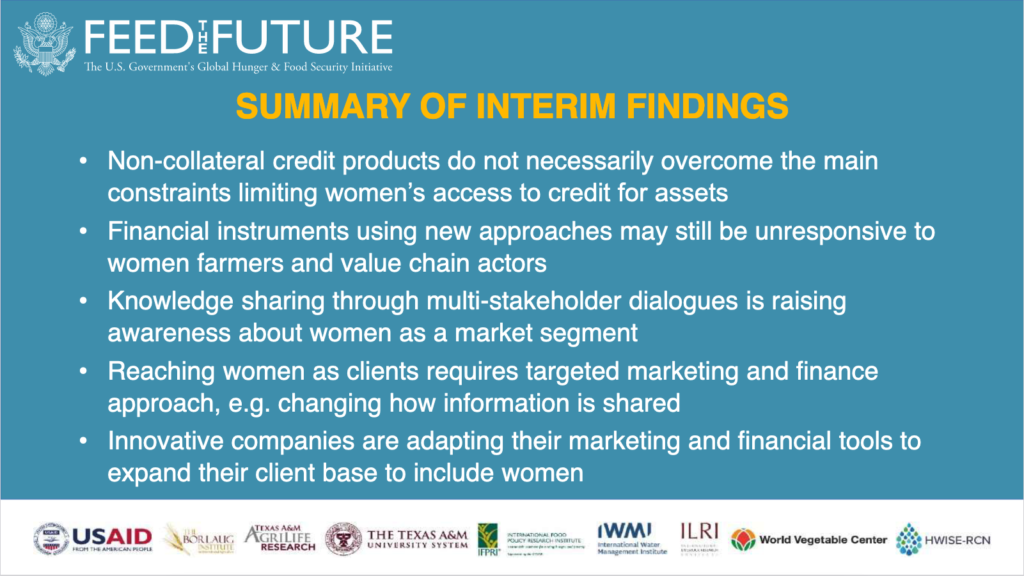

In Small-Scale Irrigation (SSI) and Women’s Empowerment (WE): Lessons from Northern Ghana, Elizabeth Bryan of the International Food Policy Research Institute (IFPRI) and her co-authors indicate that small scale irrigation has benefits for women, but it is not always the most desirable pathway to women’s empowerment. However, asset ownership – along with control over income and production decisions – do seem to contribute to women’s empowerment.

Still, achieving asset ownership remains a stumbling block. Despite the link between asset ownership and empowerment, as Bryan and co-authors point out, women face considerable resource constraints, such as lack of secure land use rights and access to labor, that further reduce their ability to get credit, and therefore interventions that strengthen women’s opportunities are needed to break the multiple and reinforcing boundaries to asset ownership. These insights help inform ILSSI’s continued work with the private sector to target women through gender-responsive asset-based financing tools.